Tax Information

Tax Impact

Bond Tax Impact

If the Bland ISD bond passes, the district projects a tax rate impact of $0.039 (4 cents). For the average home in BISD valued at $287,230, that impact would be $4.76 per month.

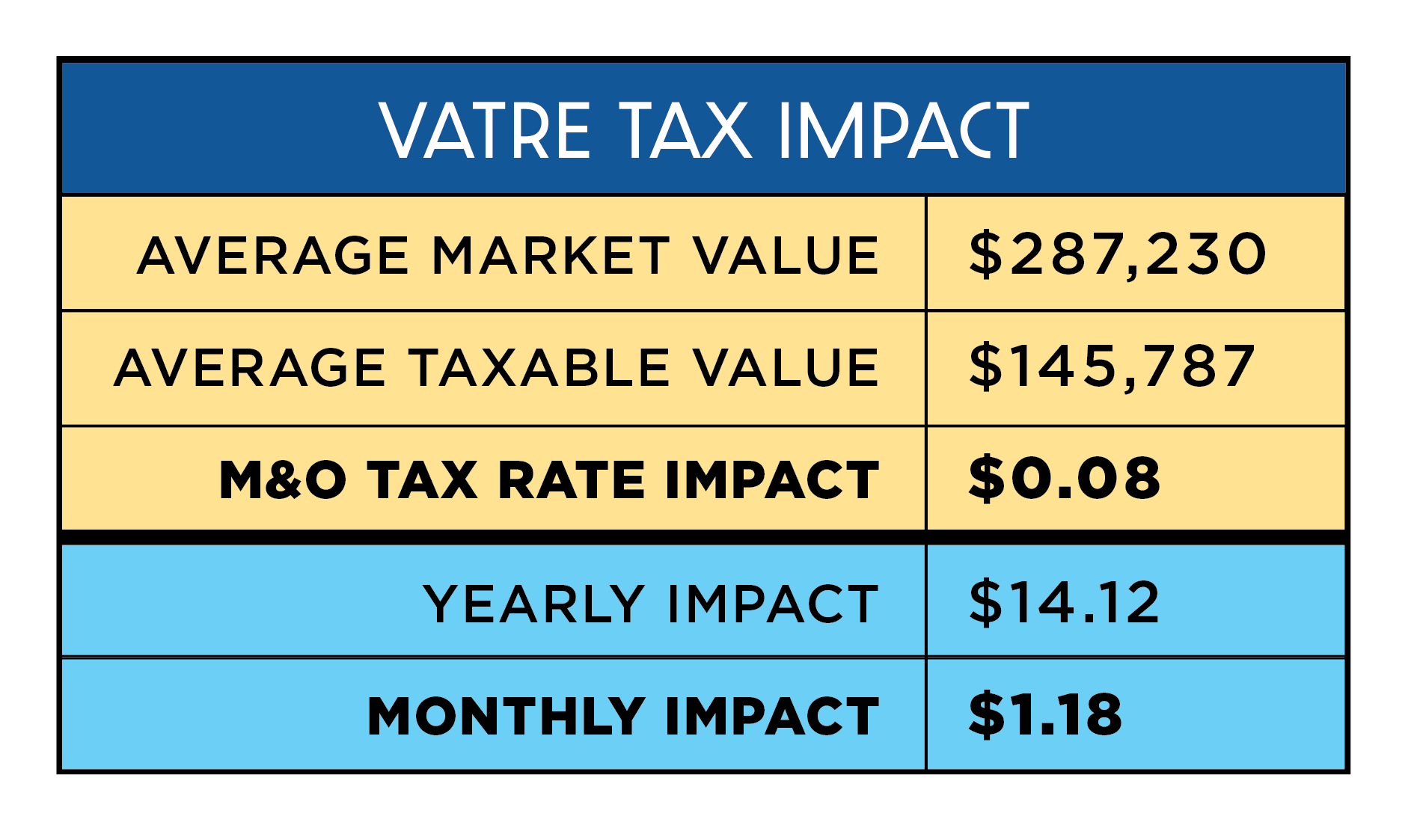

VATRE Tax Impact

If the Bland ISD VATRE passes, the district projects a tax rate impact of $0.08 (8 cents). For the average home in BISD valued at $287,230, that impact would be $1.18 per month.

VATRE & Bond Tax Impact

If both propositions pass—the Bland ISD bond and VATRE—pass, the district projects a tax rate impact of $0.119 (12 cents). For the average home in BISD valued at $287,230, that impact would be $5.94 per month.

*ALL TAX impact PROJECTIONS include a $140,000 homestead exemption proposed for November 4, 2025. If approved, all Texas homeowners would be eligible for a $140,000 state homestead exemption on school taxes—an increase of $40,000 from the current $100,000 exemption.Tax History

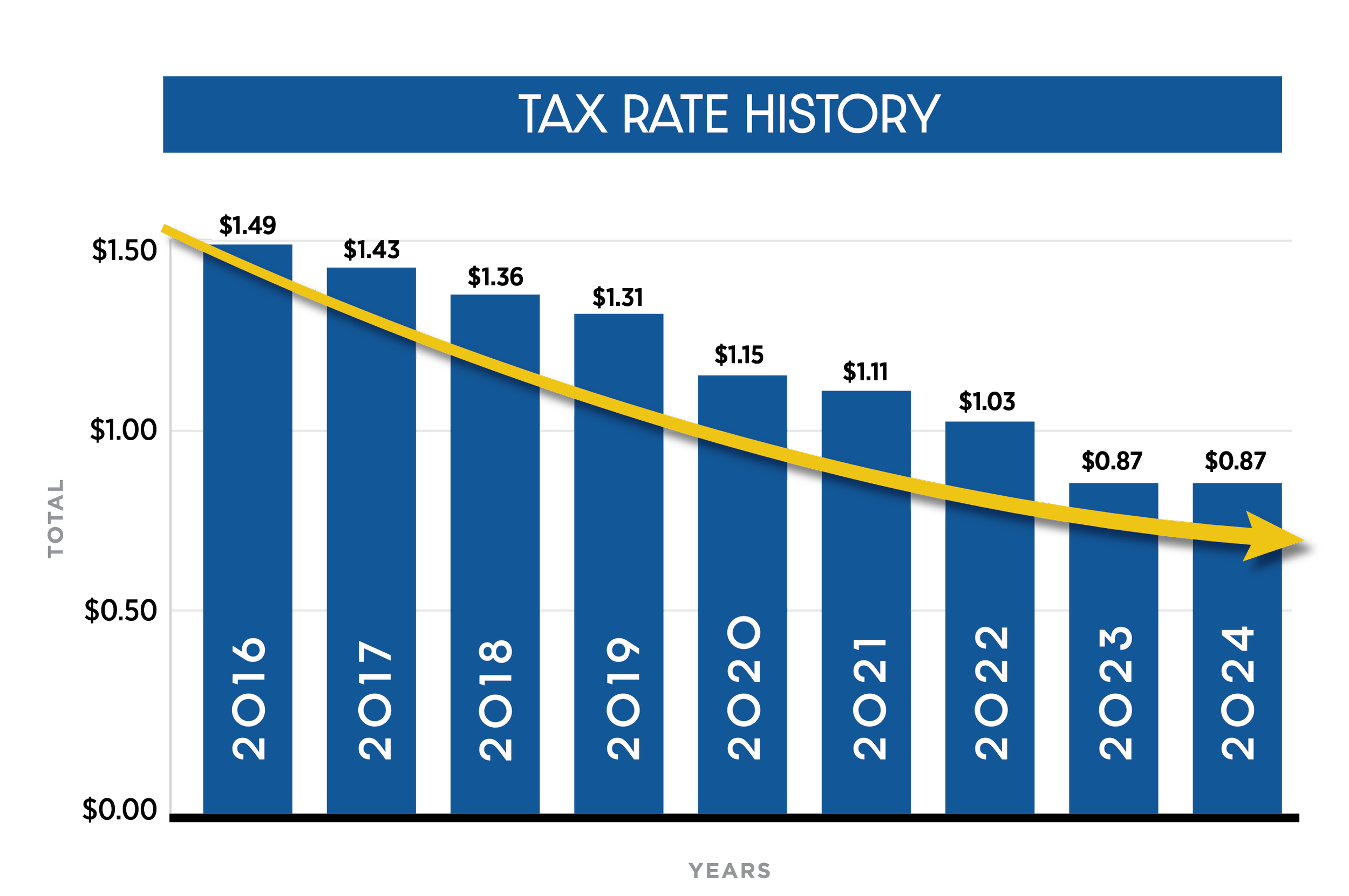

Bland ISD’s total tax rate has decreased by $0.62 (62 cents) since 2016.

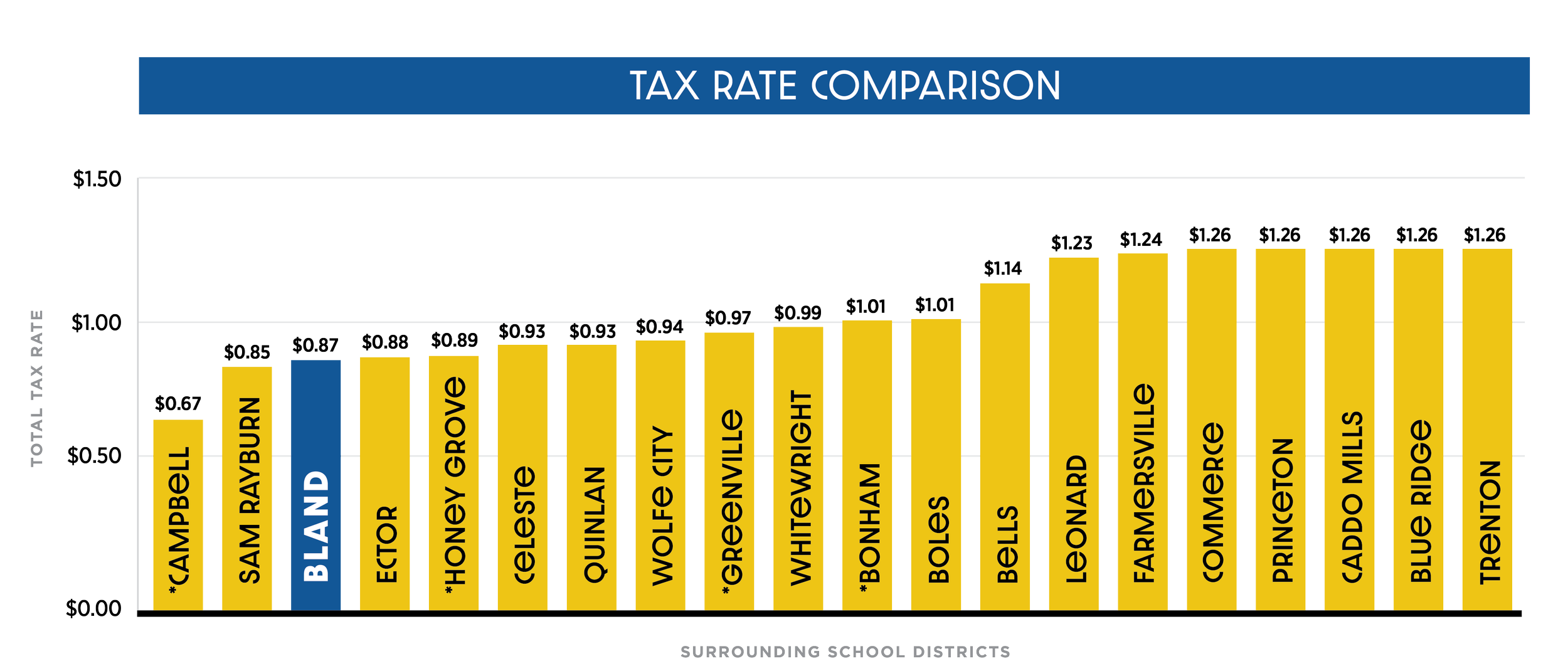

Bland ISD has the third-lowest tax rate compared to districts in the surrounding area.

School Finance

101

A school district’s tax rate is comprised of two components: the Maintenance & Operations tax (M&O) and the Interest & Sinking tax (I&S). Bond sales only affect the I&S rate. VATRE elections only affect the M&O rate.

What is M&O and I&S?

Maintenance and Operation (M&O) funds are primarily used for the ongoing operational needs of the district. These funds ensure that the schools can function on a day-to-day basis. They include:

Salaries

Utilities

Supplies

If approved, the VATRE (Voter-Approval Tax Ratification Election) would increase the M&O tax rate.

Interest and Sinking (I&S) funds are used for paying off debt incurred by the school district, typically for:

Construction of new school buildings

Renovation or major repairs of existing facilities

Purchase of large equipment or other capital investments

If approved, the bond election would increase the I&S tax rate.

65+ and/or Disabled Exemption

If you qualify for an age 65+ or disabled person residence homestead exemption, the tax ceiling is the amount you pay in the year you qualified for your exemption. The school district taxes on your residence homestead may go below, but not above the ceiling amount. You must apply for this exemption.

You must apply for this exemption.

Why will my ballot read “THIS IS A PROPERTY TAX INCREASE” if I have an approved homestead exemption?

The Texas legislature passed laws in 2019 requiring all school bond elections to include the following language on the ballot: “THIS IS A PROPERTY TAX INCREASE”. The state mandates that all bond ballots include this language, regardless of what individual exemptions each voter may have.